Private Client Services

We understand that each individual and family has unique needs and circumstances, which is why our Private Client Services team takes a personalized approach to create tailored risk management solutions.

By conducting a comprehensive analysis of your assets, lifestyle, and goals, we are able to provide you with a customized plan that addresses your specific concerns and safeguards your financial well-being. With our guidance and expertise, you can have peace of mind knowing that your assets and loved ones are protected from unforeseen events that could impact your financial security.

Our Process

Step 1: Personal Risk Assessment

Our process begins with a complimentary Personal Risk Assessment. Our team performs a thorough analysis of your personal risk profile to identify your asset and liability protection needs. This includes an analysis of your exposure to risk based on your lifestyle, as well as reviewing your existing insurance program to identify any potential gaps in coverage. Complete the form below to receive your complimentary Personal Risk Assessment.

Step 2: Customized Solutions

Based on your individual personal risk assessment, we present you with options and recommendations custom-tailored to your specific needs. We leverage our strategic partnerships with specialized insurance carriers to deliver you customized solutions.

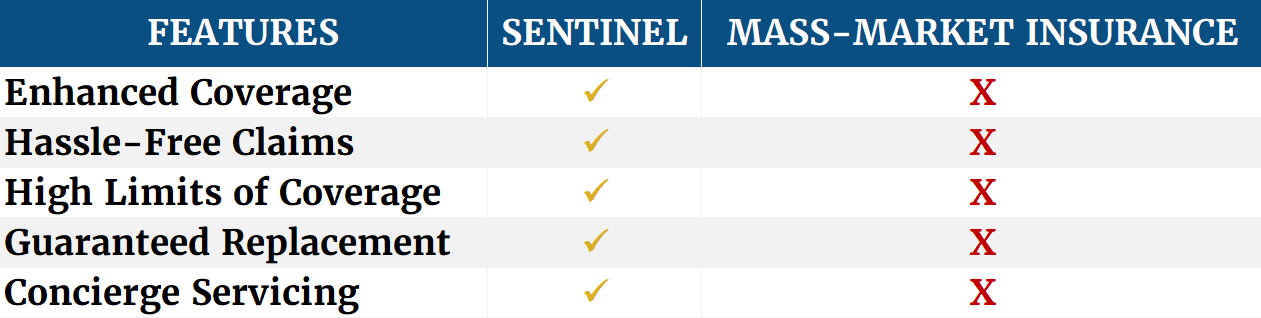

High-end homes deserve high-end protection. We offer specialized coverage solutions not available with mass-market insurance.

Guaranteed Replacement Cost

Coverage is extended beyond the policy limits if you need to rebuild or restore your home after a loss.

Replacement Cost for Contents

Provides the full amount needed to replace damaged personal property.

Deductible Waiver

You pay no out-of-pocket deductible on losses greater than $50,000

Additional Living Expense

You’ll be provided comparable temporary housing if you are displaced from your home due to a covered claim.

Mortgage Expense

After a covered loss, your mortgage payments are covered during the restoration period for up to one year.

Exceptional Claims Service

Our carriers typically contact you within 24 hours of a reported loss. In many instances payment can be issued within 48 hours of settlement.

We offer solutions that allow you to be fully covered, no matter what type of vehicle you own. You can pick and choose the options that work best for you.

Agreed Value Loss Settlement

When your policy is issued, we’ll work with you to determine a fixed amount you will be paid in the event of a total loss, regardless of depreciation and without a deductible.

Original Replacement Parts

If your car can be repaired, we will help ensure that they are performed to the highest standard. Your policy covers the full cost of original equipment manufacturers’ (OEM) parts.

Rental Car Coverage

If you need a temporary car while yours is being fixed after a covered loss, you’ll be able to choose one that fits your needs.

Temporary Emergency Living Expense

If you experience a covered loss more than 50 miles from home, you’ll have coverage to pay for meals and lodging while your vehicle is repaired.

Solutions to cover all of your special items – from jewelry to artwork, china, wine and antiques, we can help safeguard your most prized possessions. Flexible Coverage Options

Flexible Coverage Options

Choose itemized (scheduled) coverage for items with known values, blanket coverage for a wider collection of lower-value items, or a combination of both.

Market Value

Pays up to 150% of the amount of your itemized coverage if the cost to replace an item exceeds the scheduled coverage.

Worldwide Coverage

Your valuables are covered at home and across the globe.

Your success and assets expose you to a greater number of liability risks, and a lost lawsuit can threaten not only your existing wealth and future earnings, but also the legacy you plan to leave for future generations.

High Limits of Cover

Liability limits up to $50 million are available.

Defense Costs

Unlimited legal defense costs for claims of personal injury and property damage are covered—even if the suit is groundless, false or fraudulent—and do not reduce the amount available to pay damages.

Specialized Liability Coverage Offerings

In certain situations a more specialized personal liability policy can help further protect your assets. Coverages available include:

Whether you own a sailboat, powerboat, or luxury yacht, we have comprehensive solutions to cover any type of vessel. Agreed Value Loss Settlement

Agreed Value Loss Settlement

Pays the hull coverage amount listed on your policy in the event of a total loss.

Emergency Towing and Assistance

If your vessel becomes disabled, you’re covered for towing and emergency assistance costs.

Hurricane Haul-Out

You’ll be reimbursed for costs incurred to move and store a vessel in order to keep it from being damaged by a named storm.

Uninsured Boater Liability

Coverage for bodily injury experienced by you and any passengers on your vessel who are injured by an uninsured vessel.

Solutions to cover most types of vehicles and toy – Recreational Vehicles, Motorcycles, Golf Carts, All-Terrain Vehicles, and more.

Step 3: Program Implementation

We make the transition seamless – deploying your new program and assisting with canceling your current policies.

Step 4: Proactive Program Management

Your dedicated service team monitors your program and conducts annual reviews to ensure that your program keeps pace with your changing lifestyle and financial circumstances.

The Sentinel Difference

Exclusive Services

Arcadia Art Consultancy is a boutique tangible asset management firm, specializing in supporting high net worth individuals build, manage, preserve, and transfer their collections of fine art, jewelry, and other luxury assets. AAC and Sentinel work collaboratively with your insurance carrier to provide the coverage limits and terms you need to properly protect your collections.

Sasser Restoration’s Green Light Priority Response Program offered by in conjunction with Sentinel helps clients prepare for and recover from catastrophic and emergent events, including hurricanes, fires, floods and biohazards. This program helps you allocate resources when they are most scarce.

Helping Professional Advisors

Our team partners with family offices, attorneys, accountants, wealth advisors, and other professionals to manage the insurance needs of affluent individuals and families. Whether working independently or in partnership with you, we assess and manage exposure so that your clients and you can rest easy. With the capabilities and resources of a national broker and the personalized attention of a regional firm, we deploy an in-depth strategic process that allows us to deliver an unparalleled, concierge-level client experience.

Copyright © 2024 Sentinel. All rights reserved.