Welcome to the ABCs of Insurance Claims. Over the next few months, Sherri Walker, Sentinel’s Director of Claims will address an aspect of claims handling for every letter of the alphabet to help provide a better understanding of the claims process.

Ice and Snow

While people often celebrate “Christmas in July,” the country seems to be having very non-Christmas like weather currently. Instead of discussing heatwaves, the letter “I” has prompted me to ponder cooler matters, namely Ice and Snow. Although these types of claims are months away, there’s important information to consider about the winter-proofing of your home or business prior to the colder months. Thus, now is a great time to consider this cooling topic.

Prevent Pipes from Freezing

One of the most common issues arising from winter ice and snowstorms is frozen pipes. When the temperatures drop, pipes can struggle to keep the temperature of the water in the lines above the freezing point. As ice forms, the pressure on water lines swells, and this can cause a crack in lines that may not be discovered until the ice begins to melt. Unfortunately, upon melting, that water must flow out somewhere. Sadly, that “somewhere” is usually in ceilings, and onto floors and other finished spaces.

To help prevent frozen pipes, it’s a good idea before the onset of cold weather to make sure that your lines are properly insulated where possible. While that’s not always an option, there are some other tricks to preventing frozen pipes, including allowing water to continuously trickle on an outdoor hose bib and keeping the property sufficiently heated and propping open cabinets with plumbing lines to prevent the temperature in the lines from dropping.

Insurance policies generally require that vacant properties maintain sufficient heating to avoid potential freezing. If you do have pipes that burst because of freezing, some policies will cover the replacement of the line so long as efforts have been made to prevent the freezing. This is one of the only scenarios in Insurance in which the damaged item itself is covered.

Prepare for Ice Damming

Another unfortunate result of cold weather is claims that arise from a phenomenon referred to as “ice damming.” This can result when thick snow falls on to the roof of a property. When the temperature outside is much lower than the temperature inside the property, the bottom layers of snow melts from the interior heat even though the outer layers are still frozen from the exterior cold.

This melted snow can refreeze from the upper layers and create pockets of ice, especially in valleys and corners of a faceted roof. As the exterior temperature rises, there is more water than the roof is able to quickly shed, often resulting in interior leaks. In areas where deep snowfalls are common, there are tools specifically to rake thick snows off of the roof, but in areas such as the South that are only hit with snowfalls like this on occasion, ice damming can occur and cause considerable damage.

Thick ice and snow also has the tendency to become extremely heavy. This excessive weight can topple certain roofs and structures. In North Carolina, after a record snowfall in December of 2018, there were a large number of carports, outbuildings and metal roofs that collapsed. It’s important to know that this does happen abruptly. It is imperative to remove valuables from directly under these structures, as well as avoid having people in these areas. Having this extent of weight collapse on a person has a definite potential to cause serious injury and even the possibility of death.

Avoid Slips, Trips, and Falls

In commercial properties, especially apartment complexes and businesses with prevalent sidewalks, slips, trips and falls become all too common during and after winter weather. It is important to take measures to clear and de-ice walkways. Records should be kept of when, how often, and by what method this maintenance is performed.

If you’ll remember back to the letter “G,” no one wants a General Liability claim filed for negligence in keeping a safe premise! Having these records show that you, as a business owner, are doing everything possible to avoid creating hazardous conditions on your property and are extremely helpful in the event of a claim.

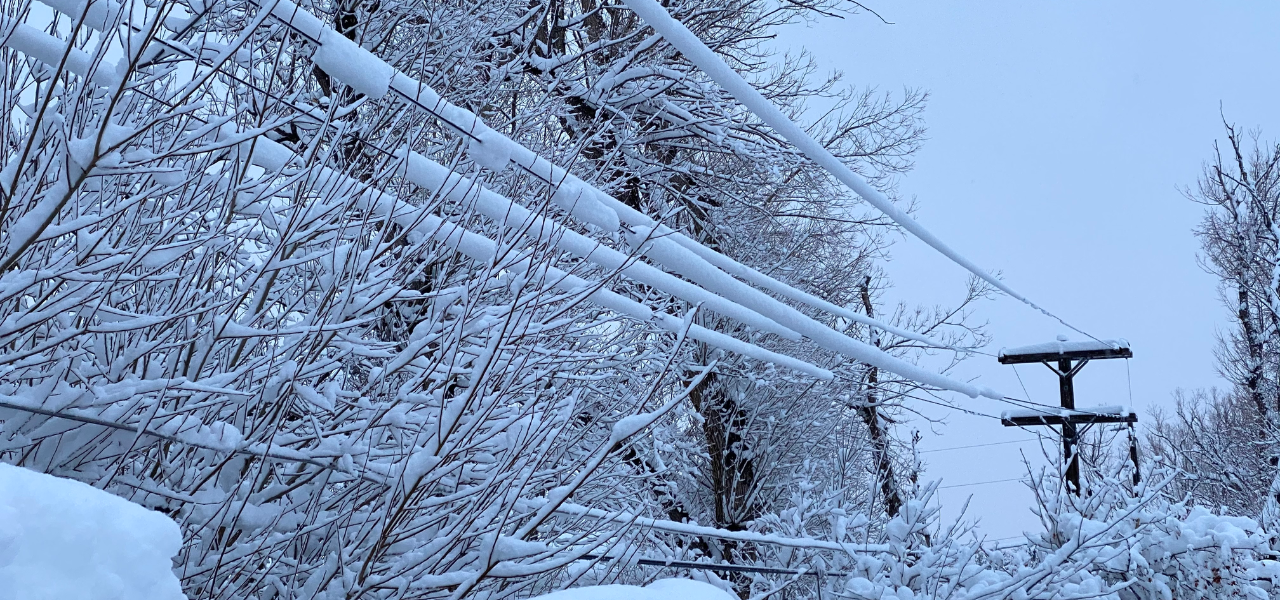

Be Proactive in the case of Power Outages

During these winter events, it is also common for power lines to be coated with ice, and for power to be lost. When this happens, there are several concerns – from the benign loss of refrigerated and frozen goods to the more serious concerns of potential fires because of generators or temporary heating.

If you have a loss of refrigerated goods, many policies do allow for a small sublimit of coverage for frozen or refrigerated goods as part of the mainline policy. Many policies allows this to be endorsed to much higher amounts as needed – especially for restaurants, pharmacies, as well as other businesses that have goods that have to be maintained at low temperature. The bigger concerns are when items such as kerosene or propane heaters, and even space heaters are used in an effort to keep warm.

A small space heater has the ability to do large damage and can even cause a total fire loss in a short period of time. If you need temporary heating, please make sure that you are checking the UL listings and safety instructions of any devices you are using. It only takes a moment for a fire to start and go sideways.

Safeguarding Your Success

While the thermometer is still in the 90s for most of us, cold weather is just around the corner. If you want to make sure your coverage is not too hot and not too cold, our dedicated team at Sentinel is happy to make sure your policies are just right. Contact Sentinel to Safeguard Your Success today.