Agriculture plays a critical role in North Carolina, with the industry contributing $103.2 billion to the overall state’s economy, ranking it the number one industry in the state. In recognition of National Agriculture Week, let us explore some key risk management topics that are of vital importance in this sector.

Technology

The agriculture industry is responsible for feeding a growing population on fewer and fewer acres every year. Therefore, the advancement of technology is critical for the industry to continue to meet the daily demands of consumers for three square meals a day.

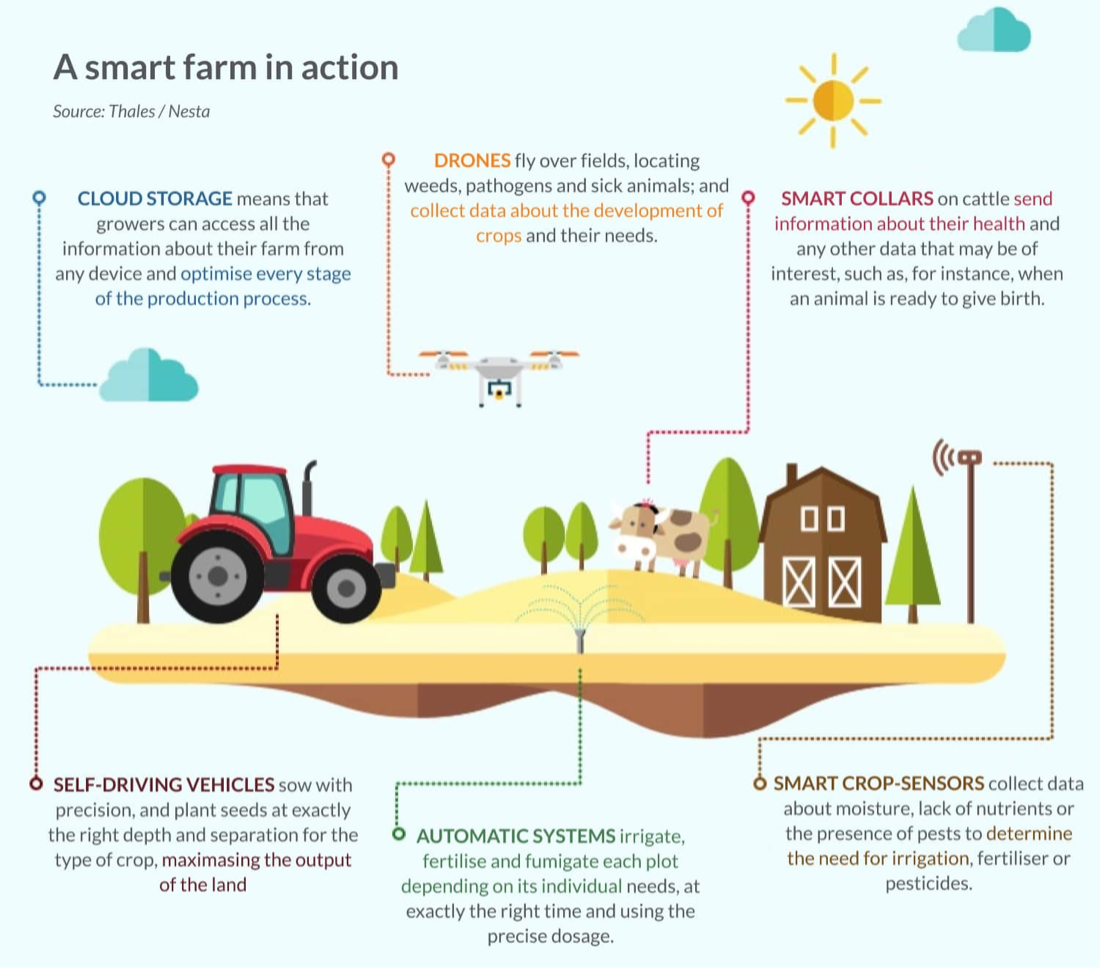

From drones to precision data analysis software, businesses require real-time data instantaneously, leading to more efficient management decisions across all aspects of the business. Consequently, it is costly to the business if technology fails or if someone hacks into the software. As such, it is imperative to have protection, including cyber security protocols, and a robust Cyber policy, to assist with interruption of business operations.

Safety

With exposure to specialized equipment in large warehouses and farm vehicles, along with other inherent risks on the farm, safety remains a top priority in the agricultural community. One thing that is often overlooked is establishing Motor Vehicle Record (MVR) criteria and Driver Acceptability charts for all employees. These small nuances can make the biggest difference in the business’ risk profile and demonstrate commitment to a safe working environment.

Another example of safety precautions involves confined spaces, including grain bins. According to a recent study at Purdue University, injuries in confined space areas increased by 45% in 2022 from the previous year. This includes both fatal and non-fatal injuries. Grain bin entry is extremely dangerous with both engulfment and suffocation hazards, along with a high risk of combustion due to grain dust. Proper training, policies and procedures, and equipment are paramount.

Business Operations

It is important to understand the role insurance plays in protecting assets on the farm. Farmers can reduce risk through sound business practices and safety policies and procedures, but there is never a way to eliminate all risks. Thus, insurance policies should be purchased to cover each farmers’ unique needs. It is common in the agricultural space to tie business and personal assets together. A thorough evaluation of exposures is recommended to ensure what is properly covered and separated, so one incident is not detrimental to a family’s operation and livelihood.

Typical policies include coverage for the homestead and contents, farm personal property and equipment, liability, automobile, workers’ compensation, and pollution/environmental coverages. Additionally, coverage for crops and livestock, inventory and fencing, loss of income, and operating expenses due to a covered loss are available. Each policy has many nuances that affect coverage at the time of loss. Insurance programs should be reviewed regularly and customized to each unique farming operation.

While the industry is facing an increase in many costs including labor, and equipment, property values are also on the rise. According to a recent USDA publishing, real estate values have increased 7.4% across the US and 7.8% in North Carolina. This further demonstrates the importance of proper analysis of current policies to stay current with the market and prevent crippling losses to business operations. There are literally hundreds of details to review to ensure your coverage offers the proper protection when you need it most.

Safeguarding Your Success

The agricultural industry is unique in many cases as personnel are responsible for wearing many different hats, including safety, risk management, insurance program development, maintaining daily business operations, and planning for the future.

Sentinel specializes in managing current risks and exposures while also preparing for future threats. We work with companies of various sizes and industries to assess your exposures, mitigate risks, and provide tailored coverage for your specific requirements, allowing you to focus on continued growth and success. Get in touch with one of our team members today to learn more.