What Workers' Compensation Claims Tell You

Workers’ Compensation provides coverage for lost wages, medical expenses, and resulting rehabilitation costs when employees are injured while working. Most states in the US (49 out of 50 in fact, Texas being the outlier) are required to carry Workers’ Compensation (WC) insurance. Workers’ Compensation laws and requirements vary by state. The cost of Workers’ Compensation insurance is paid by employers with benefits paid to the employee.

To qualify for Workers’ Compensation benefits, the claim must be deemed compensable, meaning the employee must sustain an injury or illness while working or performing work-related tasks. There are caveats that insurance adjusters consider when investigating and determining if an employee qualifies for benefits. Just because an injury occurred at the workplace doesn’t necessarily mean coverage will automatically apply.

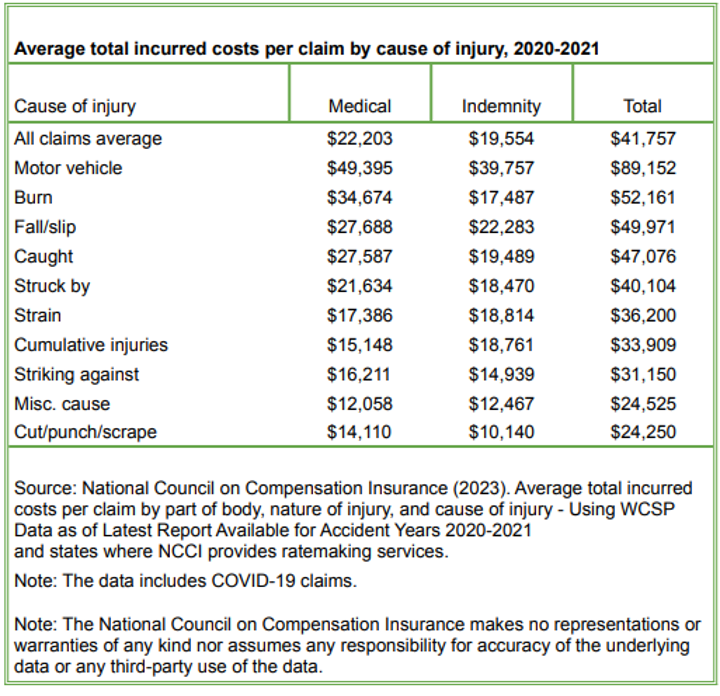

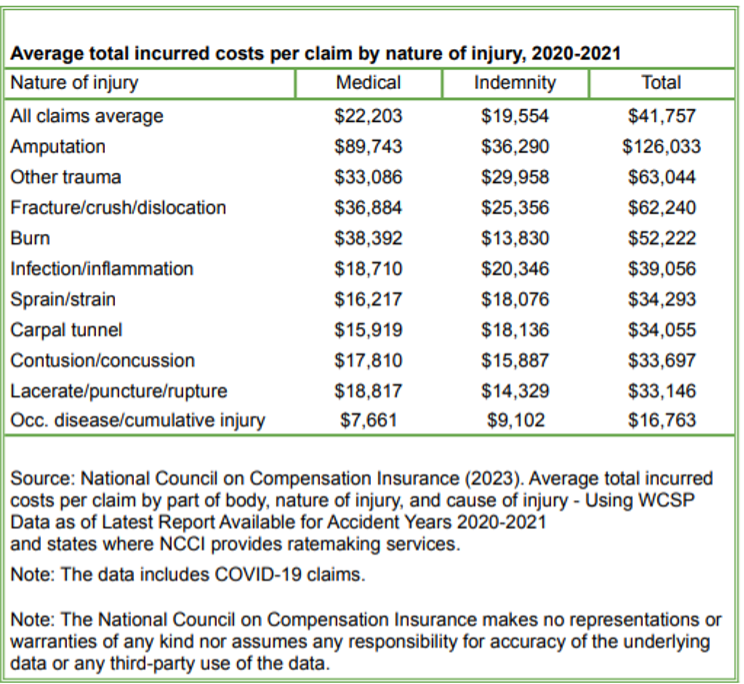

Workers’ Compensation claims are classified as Medical or Indemnity claims, depending on if the injured worker sustains injury resulting in medical expenses or loses productivity time away from the workplace. The nature and severity of Workers’ Compensation claims can influence future premiums and your overall risk profile with your insurance carrier. Injuries stemming from the workplace can be costly, especially those that require ongoing medical treatment, surgeries, extensive lost time from work, etc. According to the National Safety Council (NSC), the average cost for all WC claims combined is in excess of $40,000

The Data

Occupational illness and injury data can serve as a valuable early warning sign for businesses and is essential for crafting effective risk management strategies to prevent future incidents. The most recent claims data collected is available from the National Council on Compensation Insurance (NCCI) from the 2020-2021 policy term. The costliest lost-time Workers’ Compensation claims by nature of injury across all industries resulted from amputation. These injuries averaged $126,033 per claim. The next highest costs were for other injuries resulting in fracture ($63,044), crush, or dislocation ($62,240), and burns ($52,222).

Industries Most Impacted

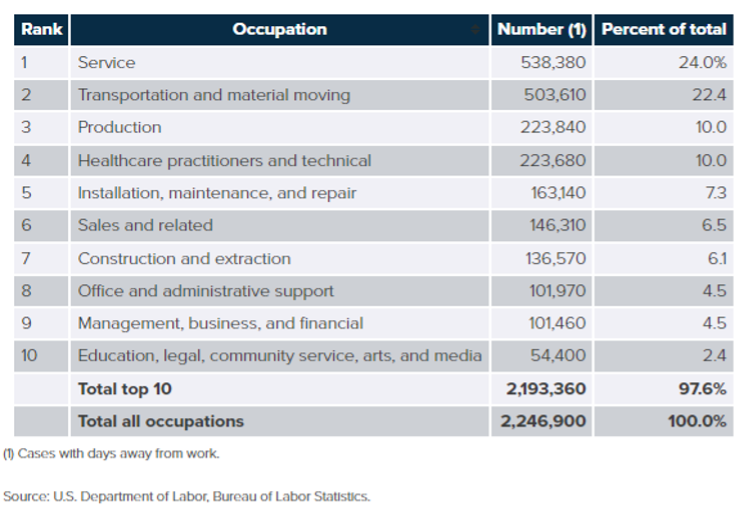

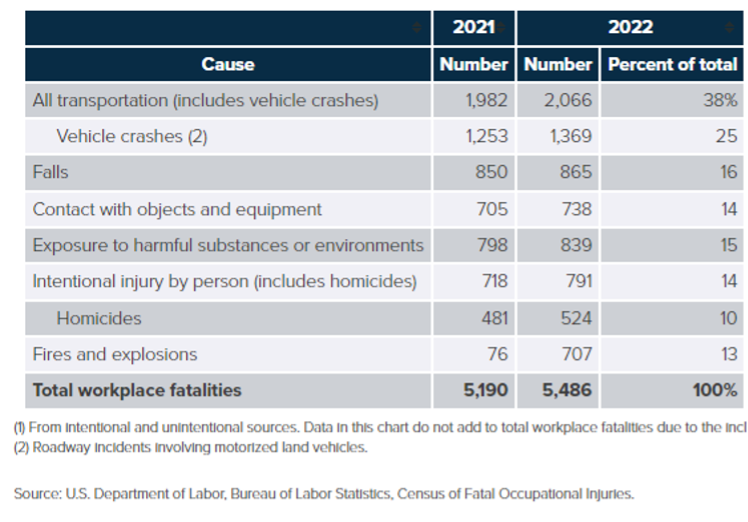

Industries with some of the highest number of claims reported include Transportation, Agriculture, Construction, Healthcare, and Manufacturing. The heightened risk is present within these industries due to the inherent nature of the job being performed.

Why Does It Matter?

Some companies might believe that Workers’ Compensation insurance serves as a safety net, implying that covered losses won’t significantly impact them long term. Although few businesses welcome Workers’ Compensation claims, their actual consequences can be more substantial than originally thought. For starters, work-related injuries can cause issues in the overall safety culture and interruptions to productivity if not mitigated properly. Not only do work-related injuries tend to lead to restricted work for essential job positions or sometimes even extended leave of absence but can also directly affect what’s called a company’s Experience Modification Factor.

What is an Experience Modification and Why is it important?

An experience modification (sometimes referred to as EMR or mod) is essentially a company’s safety “score” in reference to their Workers’ Compensation claims activity. This score is a numerical value that represents a company’s workers’ compensation claims activity compared to other firms with the same industry classifications. It is intended to encourage an emphasis on safety and encourage the prevention of incidents leading to losses.

The mod is calculated by a company’s actual losses incurred divided by expected losses. The expected loss figure is determined by the company’s payroll and class code(s). A mod factor of 1.0 indicates that a company’s claims history is considered average. A mod above 1.0 means a company’s claims history is worse than average, while a mod below 1.0 means it’s better than average. Insurance carriers will use this mod rating as a risk analysis tool when assessing your overall risk profile and WC coverage. This factor is directly impactful on the premium charged for workers compensation insurance coverage.

So, the mod rating affects your coverage and costs with the carrier, now what? The goal is to keep the mod as low as possible. In fact, each industry class has a ‘minimum mod’ that should be strived for. This factor reflects the lowest score available if no claims were ever filed or paid.

How does a company keep their mod low? Controls must be in place for any company to keep their claims down and their resulting experience modification in good standing. Robust safety controls lead to less claims activity, thus maintaining a lower mod. The following tools are common risk management solutions used to help companies meet this goal:

- Safety Programs & Policies

- Training

- Regular Auditing

- Job Hazard Analysis

- Safety Assessments and Corrective Action Plans

- Robust Incident Investigations

- Return to Work program

Need Help With Preventitive Strategies To Get In Front Of WC Claims?

A crucial first step is to analyze workers’ compensation trends by reviewing past claims. Identifying the root causes of recurring injury types allows for corrective actions to be implemented, helping to prevent future incidents. By analyzing trends in Workers’ Compensation claims within your industry, you can uncover underlying causes and take proactive measures to prevent future losses.

Sentinel provides a team of Risk Engineering and Claims Experts who offer customized services designed to mitigate potential incidents, manage new and ongoing claims, and implement additional risk management solutions to support your company’s success. Contact us today to further understand your experience modification factor, enhance your safety culture, and learn about Safeguarding Your Success.